What Benefits Are Means-Tested? DWP Payments You Can Claim

Estimated Reading Time: 6 minutes

Means-tested benefits give financial support to those who may need it - such as people with lower income and savings - helping them cope with rising living costs.

Below, we’ve highlighted what benefits are means-tested (such as Council Tax Support and Income-related Employment and Support Allowance), so you know which benefits you are and aren’t eligible for.

Means-tested benefits are awarded based on your income and savings. Many pensioners are eligible for these benefits too. You’ll also find useful information on what’s included in a means test, capital limits and how deprivation of assets works.

Arrange care at home

Browse the best home care in your area.

In this article:

- What are means-tested benefits?

- What benefits are means-tested?

- What benefits aren’t means-tested?

- What’s included in a means test?

- Capital limits for means-tested benefits

- Deprivation of assets

- Are means-tested benefit rates going up?

What Are Means-Tested Benefits?

Means-tested benefits are awarded based on your income and how much savings you have. To be eligible, you’ll need to demonstrate your income and savings are below a certain level (this varies from benefit to benefit).

How much of a means-tested benefit you’re eligible for can also vary, depending on several factors. Often, how much you get will be the difference between your earnings and how much extra you need to live on.

What Benefits Are Means-Tested?

- Council Tax Support

- Housing Benefit

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Income Support

- Pension Credit

- Social Fund (including the Sure Start Maternity Grant, Funeral Payment, Cold Weather Payment and £900 Cost of Living Payment)

- Tax Credits (working tax credit and child tax credit)

- Universal Credit

- Other qualifying European Union welfare benefits

What Benefits Aren’t Means-Tested?

Benefits which aren’t means-tested are usually instead awarded to people who require additional care or find completing everyday tasks more difficult due to an illness, medical condition or disability. Mobility may also be limited because of this condition.

Here are the non-means-tested disability benefits in the UK:

- Adult Disability Payment (for people living in Scotland)

- Attendance Allowance

- Carer’s Allowance (if you look after somebody with extra care needs for 35 hours a week or more)

- Disability Living Allowance (this is gradually being replaced by other benefits)

- New style Employment and Support Allowance (ESA)

- Personal Independence Payment (PIP)

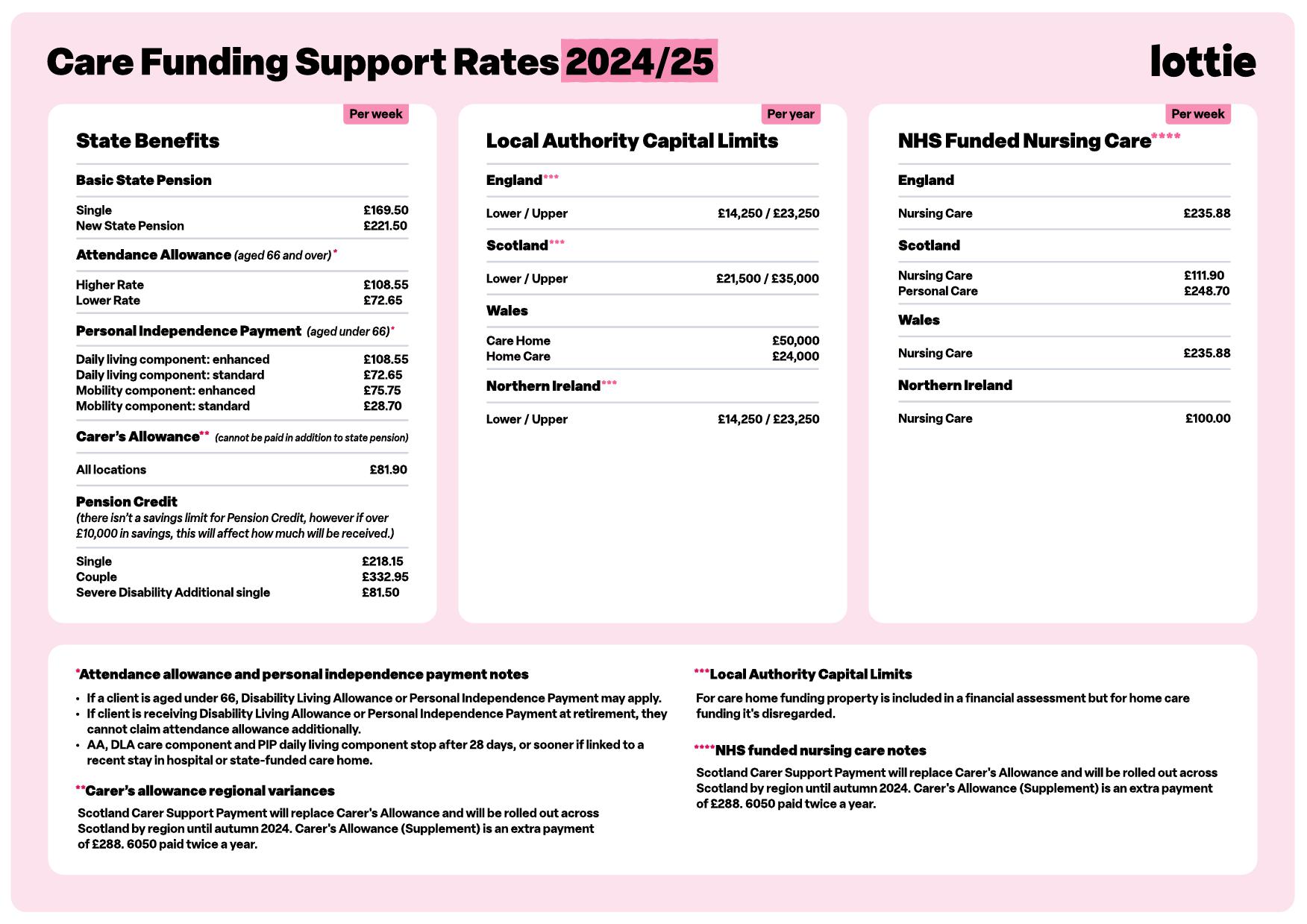

Here are the 2024/2025 care funding support and benefit rates, including for many of the benefits discussed in this article:

We have guides explaining the medical conditions that could make you eligible for Attendance Allowance, Disability Living Allowance and Personal Independence Payment.

Bereavement Support Payment and the State Pension are also non-means-tested benefits (but aren’t disability benefits).

We can help you find the best home carer for you or your loved one’s care needs, including domiciliary (hourly) and live-in carers. Request a free list of home care agencies, and our care experts will match you with suitable carers with availability in your local area.

What’s Included In a Means Test?

To be eligible for any of the benefits listed in this article, you need to prove your total capital is below a certain threshold. Before being approved, your income, savings and assets will be checked to work out how much you have in total.

There are several benefits calculators you can use to work out your total capital and which means-tested benefits you’re eligible for, including:

When using one of these calculators, you should enter all relevant savings, income and assets that could be classed as ‘capital’. We’ve explained what’s most commonly included below (though this does differ slightly from benefit to benefit).

When it comes to DWP means-tested benefits, the following could be counted as ‘capital’ during a financial assessment:

- Savings

- A share of any savings you jointly own with other people

- National Savings accounts and certificates

- Investments (such as stocks and shares)

- Income Bonds and Premium Bonds

- Lump sums (such as those taken from a pension fund, redundancy pay or employment tribunal awards)

- One-off payments

- Property (other than your own home)

- Any other assets

Any lump sum payments you received from deferring your State Pension aren’t included as capital.

Capital Limits For Means-Tested Benefits

Your eligibility for means-tested DWP benefits is determined by your income and capital. This limit is a government estimation of how much you need to live on.

The lower capital limit is £6,000 (or £10,000 for some claimants living in a care home). If your capital is below these amounts, you should be eligible for maximum support.

Usually, you aren’t eligible for any means-tested benefits if your capital is over £16,000. This is known as the upper capital limit.

If your capital is between these lower and upper limits, you’ll qualify for partial support.

What Is Deprivation of Assets?

A deprivation of assets (also known as a deprivation of capital) is where you reduce your capital - such as income, savings or assets - to make yourself eligible for a means-tested benefit.

If your local council believes you’ve done this intentionally, they may calculate your total capital as though you still possess these assets or savings.

Deprivation of assets is also common when it comes to paying care home fees, with many people reducing their assets so they don’t have to pay as much towards the cost of a care home. In this case, if the council believes you’ve intentionally reduced your assets, you may still have to pay for your own care.

Are Means-Tested Benefit Rates Going Up?

Yes, the amount you get from means-tested benefits is going up each year. For example, payment rates for most means-tested benefits increased by 6.7% in April 2024, in line with inflation.

The benefit cap (the maximum amount of benefits you can receive) rose by 10.1% in April 2023, but has remained the same for the 2024/2025 tax year. For example, the cap increased from £20,000 to £22,020 a year for single parents with dependent children living outside of Greater London.

This cap only applies to people of working age. You aren’t affected by the cap if you’ve reached the State Pension age.

We’re on a mission to support individuals and their loved ones throughout each stage of their later living journey. For more information, check out everything Lottie has to offer.

Frequently Asked Questions

What’s classed as a means-tested benefit?

Benefits are classed as means-tested if your eligibility is determined by the amount of money you have and how much you earn. You’ll be eligible for means-tested benefits when you can show that your income and savings are below a certain threshold.

What benefits aren’t means-tested?

In the UK, benefits that aren’t means-tested are usually for people who require additional daily support, often as a result of a medical condition, illness or disability. Common examples of these disability benefits include Personal Independence Payment (PIP) and Attendance Allowance.

Is PIP a means-tested benefit?

Personal Independence Payment (PIP) isn’t a means-tested benefit, as your income or savings don’t affect your eligibility. Instead, your eligibility is determined by whether you have a medical condition or disability that causes you to find everyday tasks and getting around more difficult.

What qualifies as a low income in the UK?

According to GOV.UK findings published in October 2022, households are classed as low-income if they earn less than 60% of the national median pay. Median income (before housing costs) for a couple with no children was just below £30,000 from January 2019 to December 2020.

Free Care Fees & Funding Email Course

Written by our team of experts and designed to help families fund later life care in England.