Immediate Needs Annuity For Care Costs

Estimated Reading Time: 12 minutes

This article was reviewed by Sara Chapin, Director of Finance at Lottie, on 24th January 2025, to ensure accurate and trustworthy information for care seekers. Sara Chapin has been a Certified Public Accountant with the National Association of State Boards of Accountancy since 2017. Next review due January 2026.

If you or your loved one quickly require a regular income to pay for care home costs or an alternative like home care, then an immediate needs annuity for care costs could be an option worth looking into.

This method of providing funding for long-term care can provide family and friends with the peace of mind of a guaranteed income that can be used to fund care. When paid directly to a care home, an immediate needs annuity is even tax-free.

In this article, we’ve explained what an immediate needs annuity is and how they work, who they’re aimed at, how much you’ll get, providers, benefits and potential risks.

Browse recommended local homes

Compare care homes with availability near you.

In this article on immediate needs annuities:

- What is an immediate needs annuity?

- How they work

- Eligibility

- Types of long term care annuity

- How much you get & payment schedule

- Rates comparison

- Benefits of long term care annuities

- Potential risks

- Deciding if an immediate care annuity is right for you

- Other funding options

- Next steps

What Is An Immediate Needs Annuity?

An immediate needs annuity is a type of insurance policy that provides a regular income, in exchange for an upfront lump sum investment.

When used for long-term care, this annuity will provide a guaranteed income for life that goes towards care costs.

One of the biggest challenges that comes with funding care is simply not knowing how long it’ll be needed for. Annuities remove this uncertainty by providing a regular and guaranteed income for as long as you or your loved one need it while receiving care; whether that’s at home or in a care home.

If you or your loved one decide to get an immediate needs annuity then it’s important that you shop around first. It’s estimated that if you had £100,000 to spend on an annuity, you could throw away as much as £30,000 if you picked an annuity provider offering the worst rates. We’d recommend seeking help from a financial adviser before making a final decision (more on this later).

How They Work

Generally, you'll use an immediate needs annuity to cover part of your own care costs or that of your loved one. You’ll then fund the rest from your income and any other resources or assets.

An immediate needs annuity is designed to cover the shortfall between your income and the cost of care for the rest of your life. This is why the price of a plan is based on how much income you or your loved one needs and the insurance company’s assessment of how long you’re likely to need it for.

Eligibility

The way that an immediate needs annuity works means that you or your family member can only buy one if you’re already receiving care or due to start receiving care soon. This is because a nominated care provider must be made the recipient of the money paid out.

Aside from that, there’s no barrier to purchasing an immediate needs annuity, assuming you have the money to pay for it.

We’re here to help you find the right care home for you or your loved one. You can request a free list of care homes from our Care Experts, who will then share homes matching your budget, location and type of care needed. You can also search for care through our easy-to-use directory.

Types Of Long Term Care Annuity

There are two main types of needs annuity. These two types differ in terms of when payments begin.

We’ve explained the differences between these below:

Immediate care annuity

Also known as an immediate needs annuity (what this article is about!), this works in a similar way to a regular annuity, with the difference being that this guaranteed income goes directly towards the cost of your care. The major advantage of this payment method is that it doesn’t count as your income, so isn’t subject to income tax.

This is the most common and popular form of annuity as it provides immediate support with care costs.

Deferred care annuity

Here, a lump sum payment is paid at the outset, but no income is received from the annuity until after a specified waiting period. Generally, this can be anything from 12 to 60 months.

During this ‘deferred’ period, care fees will need to be paid from other resources, incomes and assets.

A deferred care annuity makes sense if you or your loved one are anticipating needing support with care costs in the near future, but aren’t going to immediately require financial support.

The advantage of a deferred needs care annuity is that for the same level of care fees, the cost can be much lower than that of an immediate care annuity. Meanwhile, the risk of paying care fees for a long period after the chosen deferred period is still covered.

How Much You Get & Payment Schedule

The amount an immediate needs annuity will cost depends on the current immediate needs annuity rate. These rates are made up of several factors, including:

- Age

- Current state of health

- Medical history

- The cost of care

- The provider’s specific annuity formula (which is used to calculate cost)

This makes it very difficult to get an instant annuity rate quote. To get a quote, you or your loved one will need to first provide some medical information. When it comes to a payment schedule, you’ll usually be able to choose between weekly, monthly and even quarterly payments.

Rates Comparison

The calculation of all the factors we mentioned above will lead to an annuity rate. This rate will be applied to the amount you or your loved one pay for the annuity.

For example, if after your age and health have been assessed, the provider offers an annuity rate of 25% while you pay £100,000 for the annuity, you'll then start receiving £25,000 a year directly towards care costs. Beyond four years you’d end up benefiting from this annuity by being given more money than what you paid for it.

As a guide, here’s a further example of what you need to pay as a lump sum to get an income of £10,000, which will then increase in the future:

Immediate Needs Annuity Rates

| Your Current Age | How Much a £10,000 Annuity Will Cost You |

|---|---|

| 70 | £135,000 |

| 75 | £115,000 |

| 80 | £75,000 |

| 85 | £55,000 |

Be aware that these are only indicative costs and can vary based on several health factors. Also, on a like-for-like basis, the difference between the best and worst annuity rates could easily be as much as 30%. To put that figure into context, if you were paying £100,000 towards an annuity then you’d effectively be throwing away £30,000 when going with the worst rate. This is why you should always seek out specialist advice when getting an annuity quote.

Benefits Of Long Term Care Annuities

There are a number of advantages to taking out a long term care annuity.

Here are some of the biggest benefits:

- Your family could potentially be left with more money and assets to inherit (though there’s no guarantee of this)

- Your loved one, family and friends will all be given peace of mind that care home costs (or that of a similar care alternative) will be at least partially covered for as long as is required

- If it goes directly to a UK registered care provider like a care home then the money from this immediate needs annuity won’t be taxed. This is what sets a care annuity apart from a regular annuity

- The majority of plans pay out a sum which is set to rise at a certain rate to counteract inflation

Potential Risks

Be sure to read this article really carefully and seek additional advice from a financial adviser if you feel it necessary. This is because an immediate needs annuity has to potential to be a very costly decision if gotten wrong, with this being a decision that can’t be revoked once a certain amount of time has elapsed.

Below, we’ve covered four potential risks associated with an immediate needs annuity:

1. Irreversible

After what is normally a one-month cooling off period, immediate needs annuity plans can’t be cancelled, meaning your loved one can’t receive their money back. This will remain the case, even if they no longer require care.

2. Might not fully cover care costs

In many cases, your loved one will only receive up to a certain amount, which might not cover all of their care costs. Care costs may increase faster than the income from the immediate needs annuity plan. In this case, your loved one may end up with an increasing shortfall that has to be funded in other ways.

If your family member is in a care home and their needs increase then the amount they pay for care may also increase.

3. It can impact benefits

If annuity payments are above a certain threshold, your family member’s entitlement to other means tested state benefits like Attendance Allowance may be affected. This can include care home benefits.

4. Potentially expensive

If your loved one sadly passes away out of the blue, you might pay more for the annuity than what’s received back in payments for their care. With that being said, some plans pay a sum to any beneficiaries if this occurs before a certain age

Deciding If An Immediate Care Annuity Is Right For You

If you or your loved one don’t need to start paying for care straight away or think you’ll only need it for a short period then an immediate needs annuity probably isn’t the right option. Before doing anything else, check whether you or your family member are eligible for NHS funding.

If any of the following apply to you or your loved one then getting an immediate care annuity may be a good decision:

- If you’re already in a care home or similar care environment

- If you have the money to pay and are willing to do so

- If you’d like the peace of mind that comes with a guaranteed income towards care fees

- If you’d like a flexible way of paying for care fees that can usually be transferred between care homes and between different forms of care

Ultimately, whether a needs annuity is right for you and your family depends on how long care will be needed for. Over time, the value for money will become greater and greater.

Some of the alternatives to an immediate needs annuity include:

- Drawing money from your pension pot

- Using an ordinary annuity

- Releasing equity from your home

- Selling your home (if going into residential care) and paying out of this lump sum

Other Funding Options

An immediate needs annuity is just one way to pay for long-term care. Here are some of the other most popular options:

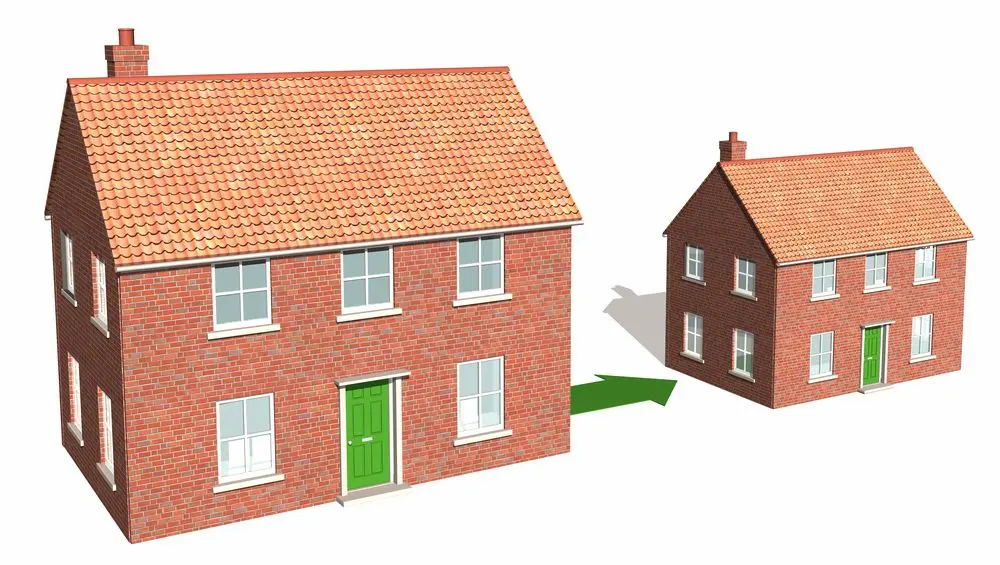

Downsizing

Selling your home and buying a cheaper or smaller one will free up money to pay for care.

12 week property disregard

If you or your loved one need to permanently live in a care home then you might be able to get the first 12 weeks free, through the 12 week property disregard.

Equity release

This will give you a lump sum or steady income from some of the money tied up in your house while you carry on living there. This money must be repaid at a later stage when the house is sold.

Investment bonds

While you can use investment bonds to pay for your care, there’s no guarantee that the returns will cover the cost of your care while your money will remain tied up for a long time.

Sale and rent back schemes

Here, you or your loved one will sell your home at a discount. In return, you can keep living there as a rent-paying tenant for a certain length of time

Next Steps

As we’ve mentioned, you and your family should obtain independent financial advice when deciding on an immediate needs annuity plan, especially considering that this is a lifelong investment. A financial adviser will be able to explain the associated risks and benefits across a range of specific circumstances.

Beyond this, there are several steps involved in the process of buying an annuity:

1. Have your plan underwritten

This will allow you or your adviser to compare options for both immediate and deferred policies.

2. Extensively search around

If a care funding plan that incorporates an annuity is your recommended solution then shop around first to find the most cost-effective solution.

3. Understand the options available to you

Make sure you fully understand all options that are available when buying an annuity, including capital protection, deferred periods, escalation and how the plan can help with inheritance tax planning (again, this is something a financial adviser can help you understand).

4. Medical assessment

Once you’ve picked an annuity provider, the next step will likely be a medical assessment to determine your state of health and life expectancy. This will help the annuity provider decide what rate to offer

Lottie matches care seekers with the best care homes for their needs. You can request a free care home shortlist from our Care Experts, who will share homes matching your budget, location and type of care needed. You can also search for care through our easy-to-use directory.

Free Care Fees & Funding Email Course

Written by our team of experts and designed to help families fund later life care in England.