This site uses services that use cookies to deliver a better experience and analyse traffic. You can learn more about the services we use in our cookies policy.

Funding elderly care in the UK

Discover the average costs of care across the UK and how much you'll need to pay for it

Robin Hill

|

Copywriter

5 September 2023

Whether it’s today or tomorrow, caring for an elderly loved one is a responsibility that many people in the UK will face. As our population ages and the need for quality care increases, it's essential to understand the financial implications involved. But rest assured, this article will map out the average costs of care across the UK, the assets required to fund care for an elderly loved one, the ideal monthly earnings to comfortably cover these expenses and the target savings for a later living.

What are the average prices of care across the UK?

The cost of care in the UK can vary significantly depending on the type of care required and the region. Below are some definitions of care and how much they cost on average:

Residential Care Homes

Residential care homes provide accommodation and around-the-clock personal care for those who find it difficult to manage daily life. On average, residential care homes cost around £760 per week. The prices can be higher in major cities and areas with a higher cost of living.

Nursing Homes

Nursing homes, which provide additional medical support via qualified nurses on-site, tend to be more expensive. The average nursing home in the UK is £960 per week, but can be higher depending on the medical support your loved one requires.

Home Care Services

For those who prefer to receive care at home, the costs can vary depending on the level of support required. Basic home care services can range from £15 to £30 per hour, while more specialised care can go up to £40 per hour.

Why does elderly care cost so much?

With such expensive costs of care, many are left scratching their heads thinking why is care so expensive? But in actuality, the answer is pretty simple. Care homes cost a lot because they provide 24-hour personal care for residents, 365 days a year, in addition to nursing care or specialist care in some cases.

Whether it’s catering for special diets or assistance with washing, dressing, going to the toilet and administering medical injections, care home costs all add up. There may also be additional charges for day trips, activities for residents, entertainment and special events. The main issue with care costs is transparency. Many care seekers find it difficult to get an exact cost breakdown. There are many reports of hidden fees, additional costs for services and facilities, not to mention sudden fee increases.

When you are starting your care home search, ask for an honest and up-front summary of a care home’s fees and always read any contract you are given thoroughly before signing.

How to Fund Care for an Elderly Loved One

Now you know the average amount and rationale, it’s vital to be prepared for the inevitable costs of this care. Don’t panic, there are many ways in which you can pay for care. Here are a few examples:

- Local authority funding. If you meet the eligible criteria (if you have less than £23,250 in savings) you can relieve some financial burden on your savings.

- Equity Release. Equity release schemes allow homeowners over a certain age to release part of the value of their property as a lump sum or regular payments. However, it's essential to seek financial advice before considering this option, as it can impact inheritance plans.

- Selling off assets. Selling property can provide a significant sum to cover care costs. In some cases, selling the family home and moving the loved one into a smaller property or a care home might be the best option.

- More Government Support. There are also some benefits from the government including: Attendance Allowance, NHS Continuing Healthcare and NHS-funded Nursing Care, Pension Credit and Savings Credit.

- Personal Savings. Of course, using personal savings is a common way to fund care. Having an emergency fund or specific funds set aside for potential care needs is crucial for peace of mind. But how much does that peace of mind cost?

Monthly Earnings to Comfortably Pay for Care

The ideal monthly earnings needed to comfortably pay for care can vary greatly depending on individual circumstances, including the level of care needed and existing assets. Those who have substantial savings or own property may rely less on monthly earnings.

However, as a general guideline, a comfortable income to cover care costs should ideally exceed the average cost of care in the respective region. Assuming an average weekly care cost of £800 (which amounts to approximately £3,467 per month), a reasonable monthly income would be at least £4,000 to £5,000, considering additional expenses such as personal needs, insurance, and other bills. For the average family, this is totally, undeniably and utterly unrealistic. Which is why it is more important than ever to start saving now for later life.

What savings do I need to pay for care?

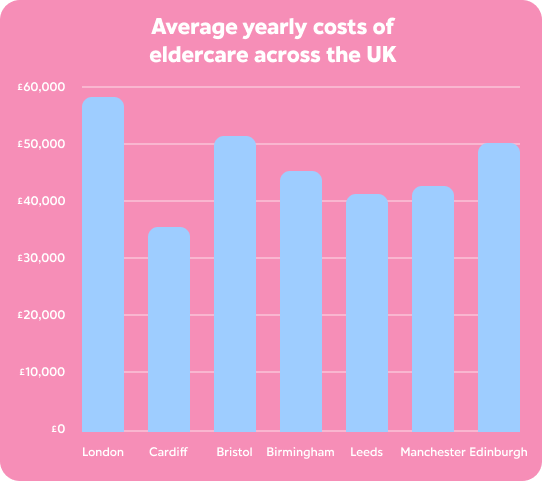

For individuals aiming to secure their financial future, having a target savings goal is crucial. Building a substantial savings cushion provides financial security in case of unexpected events or escalating care costs. The target savings amount may vary depending on individual preferences and circumstances, but aiming for at least six to twelve months of living expenses is a good starting point. As you would expect, the most expensive price to pay for care is within London, which would cost an average of £57,928. At the opposite end of the spectrum, Cardiff was the cheapest in the UK costing about £35,984 per annum.

Here is a quick breakdown of varying prices across the UK:

For those that look daunted by those numbers, fear not. Exploring long-term care insurance options can provide additional peace of mind, ensuring that adequate coverage is available when needed without draining personal savings.

Caring for an elderly loved one in the UK involves understanding the average costs of care, identifying available assets and planning for the future. The expenses for care can be significant, but with proper financial planning, including savings and insurance, individuals can confidently face the responsibility of supporting their loved ones during their next chapter. Seeking professional financial advice is highly recommended to develop a tailored plan that suits your unique situation and ensures a secure financial future for all involved.

Other insights

A collection of engaging articles, guides and insights for leading Benefits Professionals